New-Wiper

News > Information > New-Wiper

Encouraged by the phenomenal success of disposable nonwoven wipes, manufacturers are now turning their attention to industrial markets.

High-end segments with critical manufacturing environments, including aerospace, electronics, pharmaceutical, printing and automobile finishing are boosting demand for cleanroom, surface preparation and other specialty industrial wipes.

The result is a situation where manufacturers are vying for share in a market traditionally dominated by reusable, laundered shop towels.

Currently, some estimates show laundered shop towels hold nearly 90% of the industrial wipers segment, but nonwoven wiper manufacturers are projecting gains in the 6% range during the next several years.

This currently lopsided market is partly a result of environmental measures intended to regulate the disposal of industrial wipers and the solvents that are applied to them.

Laundered shop rags have enjoyed relative immunity from these regulations due to a misconception that laundering for re-use makes them more environmentally friendly than their disposable counterparts.

A classification difference between laundered and disposable wipes has exempted laundered rags from the definition of hazardous waste, and the nonwovens industry is bearing the brunt of this misclassification. The classification of nonwovens wipers as hazardous waste and the costs and efforts involved in safe disposal of these products give them an unfair disadvantage against laundered towels.

The U.S. Environmental Protection Agency, Washington D.C., has jurisdiction over waste disposal in the U.S., and the Federal law governing the storage, handling and disposal of hazardous waste is known as RCRA, the Resource Conservation Recovery Act. For the past 18 years, the nonwovens industry, spearheaded by INDA, the Association of the Nonwovens Fabric Industry, has pressed EPA to classify all industrial wipers by the solvents applied to them, not by the substrates themselves. These efforts have yielded minimal results until recently, when EPA proposed a modification to its hazardous waste management regulations under RCRA for certain solvent-contaminated materials including laundered shop towels and disposable wipes.

The proposal

On November 23, EPA sought to clarify Federal standards regarding the handling, transportation and disposal of wiping products that are treated with industrial solvents.

For the first time, regulations would include laundered shop towels into the RCRA program. Since Congress passed RCRA in the 1970s, the EPA has exempted laundered shop towels from RCRA waste disposal standards as long as the state governments regulated the laundering of shop towels.

Shop towels have historically fallen under jurisdiction of EPA’s Office of Water Management because their solvents are removed in the laundering process and returned to public water supplies for processing. This exempts them from the definition of solid waste and by extension hazardous waste. Unlike laundered wipes, since day one, disposable wipes have been regulated under the Office of Solid Waste and could earn the hazardous waste definition if certain criteria are met.

|

“There is definite growth in the industrial wipes market, with projections in the 4-6% range annually through 2008,” said Paul Farren, vice president, and general manager nonwovens, Georgia-Pacific, who predicted that such an action could propel industrial wipe growth to nearly 10%. “There have been problems in the manufacturing segment due to the EPA regulations. Although no overnight changes are expected, if the rules are modified, any change would present an enormous opportunity.”

The Conditions

Generally speaking, laundered shop towels remain exempted from solid waste classification, and thus may never be classified hazardous waste. Generators must store and transport them in covered containers after use, and ensure they are not dripping with solvents, a condition that would allow launderers to refuse a shipment. Once a laundry accepts the shipment, the generator’s responsibility is finished.

Disposable wipes, if certain conditions are met, can be exempt from the definition of hazardous waste but have always been classified as solid waste.

They too must be stored after use by the generator in a covered container but, when transported to a disposal facility, the container must clearly identify the cargo as contaminated with solvents. If disposal is to occur at a municipal solid waste incinerator, the non-laundered wipers must contain no free liquids. Disposal at a municipal solid waste landfill requires the rags be dry and contain no more than five grams of solvents. Therefore, removing solvents is yet another responsibility placed on the generator.

Additionally, EPA has published a list of solvents, such as acetone, that under no conditions can be placed in a landfill.

The nonwovens camp finds the EPA’s inequitable disposal requirements between the wipes and towels questionable, since contaminants possessing the hazardous characteristics of ignitability, corrosivity, reactivity or toxicity must be disposed of according to guidelines set under RCRA, regardless of the wipe style.

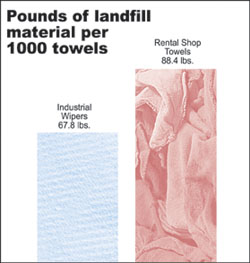

“The industrial laundry rhetoric is that laundered shop towels are environmentally friendlier than non-laundered wipes, which simply isn’t supported by the facts,” said Robert Peterson, business manager, new business development, for DuPont Nonwovens, Wilmington, DE.

“The soil on the laundered wipes ends up in the landfills, via launderers sludge. If it isn’t captured in sludge it can be released into public rivers and streams. So really it’s a charade.”

Although the primary EPA goal is to establish a Federal framework for the handling and disposal of industrial wipers and the solvents applied to them, the conditions, as written, can be viewed as both advantageous and par for the course for laundered shop towels. A fringe benefit for the laundered towels, regardless of the proposed rule change, is end users with an eye on the bottom line will be reluctant to pay extra disposal fees for wipers deemed hazardous.

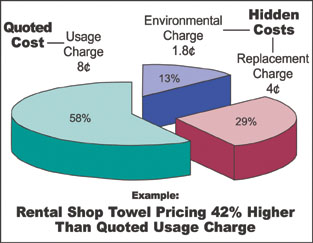

| TABLE 1 Hidden Costs for Laundered Shop Towels |

|

Exempt from the costs associated with hazardous waste, one would believe laundered shop rags are the most economic choice for their needs.

In reality, however, hidden fees charged by launderers can add up. Laundries assume the user will lose or damage up to 10% of the towels, and automatically tack on fees to cover costs associated with this estimate.

Waste and management costs passed on to the user are generally an additional 15%. Many launderers will charge users for an inventory level, not actual usage and factor cost by weight.

INDA concerns

In terms of inequities, INDA’s concerns lie in the fact that identical solvents require labeling for transport to landfills and incinerators but notfor release into public drinking water sources. Eyebrows are raised because non-laundered products destined for landfills, must be dry; yet laundered towels containing the same solvents need only meet non-dripping standards. “RCRA is not about the towels; it’s about the waste they contain,” warned Ralph Solarski, of Kimberly-Clark, who serves as president of INDA’s Focused Interest Committee for Wipers. INDA believes all wiping products should be exempt, under certain conditions, from the designation of hazardous waste, but conditions regulating disposal should be equitable for both types of wiping products and related to the solvents they contain.

Peter Mayberry, INDA director of governmental affairs, Washington, D.C., said that INDA agrees with a standard of no dripping. To remove the maximum solvent, INDA feels generators should hand wring the wipes before placing them in disposal receptacles. “Hand wringing should be required because it would…facilitate recycling of used solvents and ensure minimum negative impact on human health and the environment,” added Mr. Mayberry.

|

| Rental shop towels can come back unclean or otherwise impaired, causing concealed dangers. |

Nonwovens Wipers Advantages

Despite regulations hampering a nonwovens’ bid for a greater market share, industry leaders cite education as an invaluable tool in expanding that segment.

Several reports laud productivity advantages of task-engineered wipers over laundered shop towels. Advances in fibers, production and dispensing technique make task customization simple. The right wiper can be used for the right job, ensuring consistency in performance.

Nonwovens wipers also benefit workplace safety with a consistently clean environment that is free from contamination, while rental shop towels can return from the laundry unclean or impaired, causing concealed dangers. These include metal shavings from lathing operations that can injure faces and hands and residual oils and chemicals to cause skin rashes. Furthermore old, worn, less-absorbent rental shop towels may allow chemicals to come into contact with hands.

A recent study conducted by environmental consulting firm Gradient Corporation, Cambridge, MA, evaluates potential exposure to metals in laundered shop towels. Samples of towels, which had been used and then laundered, were collected from 23 locations in 14 states. They were then submitted to an independent lab, which analyzed them for 27 metals, as well as for oil and grease.

All of the laundered shop towels contained oil and grease, and many contained elevated levels of metals, such as lead. The study concluded that metals on these towels can get onto hands and then inadvertently get into the mouth and be swallowed. Based on using 2.5 towels per day, the study also showed that the amount of lead that someone might accidentally ingest from the laundered shop towels was essentially equivalent to California Environmental Protection Agency’s (CalEPA) Maximum Allowable Daily Level (MADL) for reproductive toxicity. More frequent daily use of the laundered towels was shown to have more dire results, including higher exposure to antimony and cadmium.

|

| DuPont has enjoyed success in the industrial market with its Sontara EC engineered-cloth wipers. They are more versatile than cloth rags, stronger and more durable than paper and less expensive in use than both. |

Nonwovens producers blame too many years of inequitable EPA regulations on the industry’s lag in developing newer, better wiping technologies for industrial applications. Those already in the market develop their product’s quality and delivery rather than invest in new technology.

G-P’s Mr. Farren said his company is further developing its airlace technology blending the benefits of airlaid pulp with spunlace technology to penetrate industrial markets. Airlace possesses the strength required for use in industrial fabrics, and G-P continues to experiment with various fibers to improve its balance of strength and price.

“The technology for applications in the industrial market is there, but a lot depends, of course, on the EPA regulations,” said Mr. Farren.

While DuPont has achieved significant success with its Sontara Industrial Wipers, the first nonwoven sterile wiping product to be designed specifically for use in the pharmaceutical, medical device and biotech industries, the company’s Mr. Peterson agreed that EPA regulations are hurting the segment.

Some wipes producers, such as Chicopee, a subsidiary of PGI Nonwovens, design their products for specific industrial applications and the proposed regulations should have relatively little impact.

|

| With nonwoven material, industrial wipes producers can guarantee customers wiper size and quality control. |

In the European market, particularly Eastern Europe, Radoslaw Muziol, vice president, Novita SA, Poland, said the demand for industrial nonwovens wipes has not yet reached its potential. Citing education and time, Mr. Muziol believes that as more Eastern European countries join the European Union, the standard of hygiene will rise.

Impacted

Larger companies that don’t rely specifically on the industrial wiper segment may weather the wipes issue, and focus on more lucrative markets until the climate is right for further research and development.

Smaller operations with stakes in the industrial market must keep a close eye on the issue while staving off lean times as U.S. industries continue to move jobs overseas.

In 1996, Jeffrey Slosman started his industrial wipers manufacturing company, National Wiper Alliance, Asheville, NC, and chose nonwovens materials for production because they allow him to guarantee his customers exact wiper size and quality control.

Mr. Slosman said he enjoyed early success from a robust customer base, but unfortunately, as the U.S. industrial market shrinks, so too, does the pool of nonwovens customers.

Asked what the future may hold for National Wiper Alliance, Mr. Slosman is cautiously optimistic. The rule proposal, he said, is only the beginning in an uphill battle for survival.

“Five years from now we will still be competing to secure the same market share, but a lot will depend on how any proposed regulation is interpreted by the EPA. No matter what’s written, most importantly is how it’s enforced.”

The Future

Based on public feedback about the proposed rule change, the EPA has three avenues to choose:

Approval, as published in November; make changes based on public input or simply decide not to issue a final ruling on this matter.

Regardless of the decision, every day hazardous materials are dumped into the environment through loopholes in the rules that govern them, and INDA will be on the front lines as long as it takes.

“We are encouraging EPA to address this issue and to go final with a rule that accomplishes increasing solvent recovery/recycling, protecting human health and the environment and providing clear, simple guidance to the hundreds of thousands of businesses that will be impacted,” said K-C’s Mr. Solarski.

The right thing to do is for EPA to take action and eliminate the confusion and complexity that has existed for years.”

nonwovens' displacement of laundered rags continues in industrial and institutional markets

Karen Bitz McIntyre

The industrial and institutional wipes market continues to offer significant opportunities for nonwovens manufacturers as more users of these materials recognize the benefits of using disposable products. Expensive to launder and often breeding grounds for infections and other hazards, reusable wipers are more frequently being replaced by disposable wipers, which offer cost effectiveness, better flexibility and more control. However, this market remains extremely price sensitive, a situation not helped by increasing raw material prices and increased capacity, and continues to face regulatory challenges such as EPA’s Office of Solid Waste’s (OSW) mandates on solid waste disposal.The market for institutional wipes contains several areas including food service, medical, general purpose and industrial, and participating in these different segments means responding to varied sets of needs and regulations. For instance, food service towels need to respond to food-related issues such as bacteria or cross-contamination, medical items respond to infection control and industrial needs to examine the types of hazards found in the manufacturing environment for which that wipe is intended. These needs are met through a number of types of nonwovens, mainly airlaid and spunlaced, but some other types of nonwoven materials are finding their way into this segment, thanks to the varied demands of its users.

|

And, while the institutional market is nowhere as large as the consumer wipes market, the continued displacement of reusables is making growth in this market inevitable, and some industry observers expect that someday the institutional side of wipes could become larger than consumer. According to INDA estimates, nonwovens’ role in this category is growing 5-6% annually in North America and this rate is supposed to continue until at least 2010.

“The reason there is a lot of growth potential isn’t unusual,” said Scott Tracey, vice president of Chicopee, nonwovens producer Polymer Group Inc.’s packaged good business. “When you think about all the areas that home care and personal care wipes are replacing, it makes the growth available because there hasn’t been a whole lot of replacement on this side of the business.”

By Mr. Tracey’s estimates, nonwovens’ penetration in institutional wipes is only about 50%. The market continues to use a great deal of laundered woven towels, which are not as cost effective as nonwovens. The cost of laundering a reusable towel often outweighs the cost of a single-use nonwoven wipe. Additionally, users tend to rinse out nonwoven wipes and use them for longer periods of time; whereas wovens are thrown in the laundry basket without being rinsed out.

“When you are looking at laundering shop towels, or any towels for that matter, if you consider the cost of rental and laundry, not to mention loss charges and damage charges, the laundering of towels always proves to be a more expensive proposition than nonwovens,” he said. “Nonwovens will last longer. If you wipe up a spill with a nonwoven wipe, they are typically apertured and able to be rinsed out. A woven towel will be thrown in the bin more quickly.”

EPA Struggle Goes On

One of the key challenges facing nonwovens’ penetration into industrial wipes has been an environmental measure intended to regulate the disposal of industrial wipers and the solvents that are applied to them. Laundered shop rages have enjoyed relative immunity from these regulations due to misconceptions that laundering for re-use makes them more environmentally friendly than their disposable counterparts. The classification has exempted laundered rags from the definition of hazardous waste while nonwoven wipers have been deemed hazardous waste and the costs and efforts behind their disposal has made them unattractive in some industrial settings.

|

The nonwovens industry, however, led by INDA, has been fighting this unfair ruling for several decades and has made some inroads into leveling the playing field. Currently, EPA’s OSW is re-doing a risk assessment of a possible ruling on the matter, which w as first proposed in 2003 and is currently under review. Among the chief goals of the proposed rule is to ensure that laundered rags and disposable wipes face similar regulations. According to OSW staff, the risk assessment has to be done so that the agency can respond to certain comments that were filed in response to the rule after its initial proposition.

“While we do not know exactly what is being re-done, we do know that OSW has expressed interest in several specific issues, and has asked for data from manufacturers of non-laundered wiping products and industrial laundries,” said Peter Mayberry, INDA’s director of government affairs. “From the non-laundered side (nonwovens and disposable rags), for instance, OSW wants information regarding changing trends related to use of industrial solvents. They specifically want data regarding the growing use of solvents that do not contain material deemed to be hazardous under the Resource Conservation and Recovery Act (RCRA) due to state and local regulations adopted over the past five years.”

As for laundered shop towels, OSW is seeking data regarding the presence of RCRA-hazardous materials contained in sludge generated as part of the laundering process. We also know that OSW is looking into the changing nature of landfills since the original risk assessment was conducted.

Virtually all municipal solid waste landfills are now required to have liners, leachate systems and other devices intended to facilitate decomposition, which was not the case 5-10 years ago, and OSW’s interest in these changes could ultimately lead to a final rule that facilitates disposal of soiled wipes in landfills (as proposed, the rule makes it fairly easy to incinerate soiled wipes as regular trash, but somewhat more difficult to simply toss them into a dumpster). OSW expects to have the risk assessment re-do finished by the end of the year, and solicit public comment on any new data in early 2007.

Based on comments received, OSW has expressed confidence that a final rule will be issued sometime in 2008. INDA, along with the SMART (the Secondary Materials and Recycled Textiles Association) is cooperating with OSW in an effort to collect any needed data and has been encouraging the Agency to finalize this rule before President Bush’s term expires, according to Mr. Mayberry.

Industry Marches On

Waiting for EPA’s final ruling hasn’t stopped new product innovation within industrial and institutional wipes. In fact, wipes companies have been working hard to balance the needs of their customers with the challenges of a price sensitive market.

|

“We have spent the last year making sure our product line is what our customers need—no more and no less,” G-P’s Mr. Eckmann explained. “That benefits them by balancing simplicity with completeness of the offering.” G-P’s latest product, GoRag uses hands-free innovation technology to dispense disposable wipers and shop towels. “There are many benefits of this electronic dispensing system including cost containment, hygiene, safety and reduction of clutter,” Mr. Eckmann added. “Costs are reduced because the locked cabinet helps eliminate pilferage and the amount of product employees grab unnecessarily. Because the enclosure on the dispenser must be locked to operate, the product stays free of contaminants in the environment, thus potentially providing even greater safety than traditionally dispensed disposable wipers.”

Beyond usage control, other key demands include health and safety, productivity and cost containment. In fact, most users of disposables chose them because of increased safety, cleanliness and more consistent quality. Of course, the cost savings is also a factor.

Chicopee has taken advantage of the flexibility of nonwoven materials by introducing new food service towels containing wipes with inherent benefits to meet the needs of specific applications. For instance, Chicopee’s new Quat-Safe towels are engineered with a patented chemistry designed not to deplete quaternary sanitizer solutions, which are used to sanitize wiping cloths and food preparation surfaces. Unlike traditional cloths, which deplete sanitizer solutions by as much as 62% after four hours, these nonwovens performed above the 200 parts per million level assuring food code standards are being met.

Launched in 2005, these Quat-Safe towels are soon to be followed by similar products that maintain the integrity of other cleaning agents such as bleach and ammonicals. “If you use a fabric that isn’t designed to work with these sanitizers or disinfectants, the fabrics can render them ineffective. They are absorbed into the rag rather than being used as a delivery tool. These nonwovens are effective in releasing the sanitizer on the surface,” Mr. Tracey explained.

Other new products from Chicopee include new designs in its Chix Utility and Chix Food service Towels with Microban antimicrobial Product Protection. Made through a spunlace manufacturing process, these towels feature better scrubbability and more apertures to capture food particles and easily rinse for reuse. The towels are color coded to prevent cross contamination. Chicopee’s All Day towels, made of pulp and polyester, are more durable compared to regular paper products, making them ideal for multiple cleaning jobs in a day. These absorbent towels with textured surfaces pick up particles and rinse easily.

Also focusing on Quat compatibility is Kimberly-Clark Professional with its WetTask Prep wipers for disinfectants and sanitizers. Billed as an ideal alternative to the use of a spray bottle or open bucket and rag, this product is available in a choice of three base sheets designed for the chemical solutions that fit a specific cleaning tasks. Users can choose the wiper that best works for their task and then add a chemical solution.

Other products available from K-C Professional include Wypall food service towels for quick-serve restaurants, convenience stores and grocery stores. The most recent introduction to this line, originally launched five years ago, is a microfiber cloth that is durable, remarkably absorbent and environmentally friendly. It can be laundered up to 300 times.

Another area seeing a great amount of play is antimicrobials, particularly in the food service area where contamination is a major concern. According to CTG/IFC Disposables’ president Bob Briggs, customers are willing to spend more on antimicrobial-based products because their benefits far outweigh the costs. “Restaurants would rather use these products even if they last for only a couple of days,” he said. “When it comes to rental towels, once they are contaminated, they stay contaminated, until they are laundered.”

Mr. Briggs’ company previously made both woven and nonwoven wipers but has phased out its rags business due to decreased demand. The company has a four-tier product line, depending on the end use requirements. Tier three and four products are launderable, spunlaced nonwovens. While they can be reused, they are not intended to be sent back to a rental company. Instead, the user can reuse them until they wear out and then throw them out. Products in the lower tiers are also made from nonwoven materials but are not designed for reuse.

The many uses for wipes in the industrial and institutional setting will continue to allow room for more nonwovens. “Nonwovens are absolutely ideal to use in these applications,” said PGI’s Mr. Tracey. “Wiping up and rinsing out is also a benefit in terms of food safety concerns. We believe the growth will be significant as education continues.”

Posted on January 26, 2007 @ 08:08 am

Converting Group To Meet Next Month

Posted on August 31, 2006 @ 09:38 amFlexible packaging is one of the leading-edge converting segments and one of the organizing companies is American FlexPack. The company will provide an overview of the single-use wipes marketplace on October 18. Also speaking will be American Custom Converting (ACC). This Green Bay converter rewinds and slits nonwovens materials and converts them into folded wipers and other products. Additionally, a representative from S&S Specialty Systems, Iron River, WI, will talk about trends in processing converted nonwovens and tissue products and how value is added to make new high-demand products.

More information: Susan Stansbury, Susan@RightAngleConcepts.com , 715-479-4117

In the healthcare sector of the nonwovens industry, R&D efforts remain focused on improved breathability, wearer comfort and increased barrier resistance for a variety of applications in both commodity and specialty markets. Meanwhile, despite ongoing technological innovation, the message from the healthcare market is clear: costs must be cut.

In

response to this dilemma, some companies have adopted a broad,

long-term approach to healthcare costs. “Cost reduction efforts may

not mean that nonwovens manufacturers will offer cheaper products,”

explained Paul Farren, vice president and general manager of

nonwovens for Georgia-Pacific. “Ultimately there are many cost

factors involved, whether they relate to labor, energy or the

environment.”

Other companies are also seeing strong pressure

from the market to control costs. For its part, roll goods giant BBA

Fiberweb expects an increase in acceptance and demand for nonwovens

and a continuation of the push to drive costs down. “Nonwovens have

proven themselves as more cost effective than traditional fabrics

for a number of reasons,” opined Betty McVey, director of BBA’s

medical business, “but now we need to focus on how we can optimize

the use of nonwovens in different applications.”

Looking

ahead, she predicted more opportunities for nonwovens. “We will see

growth in Europe and Asia, which are really still in their infancy

stages. In the U.S., the question is how to utilize new technologies

in existing nonwoven products to make them more effective and

cost-efficient while finding new applications,” she said.

Ms.

McVey referred to the recent effect of the Association of the

Advancement of Medical Instrumentation (AAMI) standards as an

opportunity for BBA to upgrade its products and offer higher levels

of protection than before. “While in the past, some customers had

been buying lower end spunbond products from China, these standards

have led customers to rethink this decision. However, the medical

market remains a challenging market where there is continuing

pressure from the healthcare industry to keep costs down,” she

added.

Another response to cost concerns in the healthcare

arena has been an increased use of spunbond nonwovens in certain

disposable apparel applications. With its recent launch of MediSoft

at IDEA04, N. Charleston, SC-based PGI is one roll goods producer

leading the shift toward spunmelt fabrics. A blend of spunmelt and

spunlace properties, MediSoft is a proprietary spunmelt product

enhanced with softness and breathability. Produced at the company’s

facility in Nanhai, China, the product is offered in the U.S. and

Asia and targets disposable apparel applications such as gowns and

facemasks.

The new MediSoft fabrics exhibit a 50% increase

in softness compared to standard spunmelt fabrics used in medical

applications, according to the company’s internal test results. The

new fabrics also exceed industry standards for protection against

fluids for their targeted class of applications. MediSoft fabrics

exceed the AAMI gown and drape industry standard (PB70) for Level

III garments of 50 centimeters in hydroheads, a measurement of

barrier properties, according to test results.

“There has

been a shift in this market to spunmelt,” commented Dennis Norman,

vice president strategic planning and communications for PGI. “The

focus on controlling costs has led to an increase in the use of

spunmelt fabrics because they offer better barrier properties on a

more economical basis,” he suggested.

Wilmington, DE-based

DuPont has also introduced a new spunmelt-based proprietary medical

fabric as part of a new family of medical fabrics. DuPont Acturel is

made of three layers—including a polyester nonwoven inner layer,

DuPont Hytrel as a breathable membrane layer and spunbonded

polypropylene as an outer layer. The first two layers are formed by

an extrusion coating process, and the final outer layer is attached

to the layer of Hytrel by an adhesive lamination process.

|

| Texel’s nonwoven Bathfelt product competes against reusable wash cloths. |

Also new from DuPont is Suprel, the first in a series of next generation fabrics supported by more than 20 new manufacturing patents. The new fabric combines a high level of protection and the ability to glide easily without catching or grabbing. It transfers heat away from the body quickly, adding to comfort in the O.R. DuPont Suprel fabric is based on DuPont Nonwovens Advanced Composite Technology (ACT), which uses a bi-component polyester/polyethylene formulation. Suprel single-use O.R. gowns are available from Medline Industries.

In another update to its medical fabrics business, DuPont has renamed its Sontara brand Softesse. The fabric represents the newest generation of DuPont’s spunlaced technology. Softesse is designed to provide acceptable barrier protection against liquid penetration as well as breathability.

In the spunbond area, a new product for medical applications has been unveiled by BBA. In conjunction with Dow Chemical, the company has launched Advanced Design Concepts (ADC), a joint venture for the development of proprietary technologies using elastic nonwovens for a number of applications. Areas with potential include medical applications such as surgical gowns and other surgical apparel.

Based on core/sheath technology, these spunbond products offer improved form and fit and use elastic nonwovens in a cost-effective way. The thermoplastic urethane and polypropylene-based products are created through a single production step without blending multiple materials as in the past. “Although ADC is in the very early stages of its launch, we have received extremely positive feedback so far,” offered Ms. McVey of BBA.

Saudi Arabia-based roll goods producer Advanced Fabrics (SAAF) has also experienced the shift toward spunmelt in medical applications. “Increasing barrier performance requirements for medical fabrics will increase the move to spunmelt,” commented Ian Disley, SAAF general manager. “We are seeing this happen, at different rates, in all the markets we are involved in worldwide.” He added that SAAF has designed fabrics to meet the new proposed FDA standards for Level I, II and III gowns at economic price and weight points. “Medalon fabric continues to penetrate the market for top end surgical gowns with high hydrohead, antistatic and alcohol repellency characteristics. A provisional patent has been filed for an SMS fabric with inherent antimicrobial characteristics,” he added.

Wisconsin-based medical products converter Triad Group has taken note of the popularity of spunbond nonwovens in the wiping segment. “We see a lot of spunbonded substrates in this market and not a lot of airlaid,” observed Ron Pontililo, director of contract manufacturing sales. Triad often uses a similar substrate for its wiping products, although it uses a variety of nonwovens technologies. “We do not use one particular nonwovens technology; we really run the gamut. The last four products we introduced were made through different technologies and all came from different suppliers,” he said.

Mr. Pontililo described 2004 as a record R&D year for Triad. The company has introduced an unprecedented number of new products and many are still in the pipeline. “We have a half dozen or so new topical patient/consumer care wipe products coming out. We will launch two or three before the end of 2004, with the balance slated to be introduced in the first quarter of 2005,” he said.

Triad’s wiping products are used in hospitals, physicians’ clinics and long-term care facilities, but some of these products cross into the consumer care sector and are offered in the mass pharmacy market. Triad offers private label products to marketers as well as to store chains. Its medical division drives the company’s consumer care business.

Counting On Composites

Another key approach for manufacturers is the use of composites to meet the varied performance demands often required of medical products. For roll goods producer Ahlstrom, such efforts are evident in the introduction of a variety of nonwoven composite products leveraging the company’s broad nonwoven portfolio with customers’ requirements of a balance between barrier, comfort and cost. “These products are currently in use as premium gowns, drapes and in auxiliary applications where these performance criteria are valued by the end user,” said Paul Marold, Jr., vice president and general manager, medical products for Ahlstrom’s FiberComposites division.

Another company benefiting from the use of composites for healthcare uses is Techni-Met, Windsor, CT. The company produces thin film coatings for nonwoven materials in medical product applications. It custom designs functional physical, electrical and chemical coatings to provide barrier, shielding, conductive, protective and reflective properties. The coated and metallized flexible materials offer potential medical application opportunities in barrier packaging, filters and screens, conductive and reflective fabrics, EMI interference shielding, charge dissipation and barrier protection materials for electronic applications, antimicrobial fabrics, wound dressing materials and other biomedical products.

Techni-Met’s vacuum-sputtered depositions are produced on a broad range of flexible substrates in widths from 6 to 62 inches and gauges .25 to 20 mils including nonwovens and polymeric films. Its precision single and multiple-layer functional thin film coatings include precious and non-magnetic metals and alloys, chemicals and compound coatings. They can be deposited onto flexible polymeric substrates, nonwovens and other materials, which can either be utilized as a stand-alone product or part of an end-use laminated or composite structure.

According to the company’s director of corporate development Charles Regul, the products are ideal for technology-driven applications. “The functional performance characteristics from thin film coatings can allow thinner, lighter and less costly materials to be used and eliminate the need for expensive, alternative materials or laminations. The coated polymeric substrates, too, can be used in slit form, in laminates with other substrate materials and as composites, depending upon end use applications and functional performance requirements,” he said.

“In the medical industry, particularly, there are many new applications in development that will effectively utilize flexible thin, film-coated products, as well as existing applications for which thin film depositions can be utilized either for performance properties or as effective alternatives to other coatings,” said Mr. Regul. Possible applications are: antimicrobial packaging, multi-layer antibacterial films, barrier-protected nonwovens, antimicrobial coated wound dressing materials, drug-eluting coatings, polymeric matrix and transdermal medication materials.

Also in the area of composites, Totowa, NJ-based Precision Custom Coatings offers a new product designed to meet the unique requirements of the medical market. The company has introduced a needlepunched product laminated with a polyurethane barrier film for use in reusable bed pad applications.

The new product is chlorine bleach resistant and can be washed multiple times. “We have been involved in lamination for some time,” explained Shaile Dusaj, director of industrial sales and marketing for PCC, “but our new focus on odor absorption and chlorine resistant products as an extension of our portfolio. These innovations are being driven in part by concerns over costs. Laminated film products are lighter, and therefore less costly, to wash than the vinyl composites that currently dominate the U.S. market. Our new laminated product offers performance and cost advantages over the product’s lifetime.”

PCC is also in the process of introducing absorbents for incontinence pad applications featuring improved odor absorption capabilities in addition to the absorption of fluids. The needlepunched nonwoven products are made from a blend of different fibers and are sold on the market in roll good form to converters targeting hospitals and institutions.

New Needlepunch

Niches

Another innovation in the needlepunch area comes

from Canadian absorbent roll goods producer Texel. In the

disposables area, Texel sells needlepunch felts for band-aid

applications to customers such as Johnson & Johnson. As for

durables, the company sells bed pads, soaker pads and adult diapers.

One emerging market for Texel is its Bathfelt needlepunched

product, which features eight no-linting wipes for post-operative

use. Each wipe is used to clean a different part of the patient’s

body, which avoids cross-contamination. The wipes are treated with

an antibacterial soap and require no rinsing. The lofty needlepunch

fabric lends the product a washcloth feel. “Spunlace fabrics try to

compete in this area, but more solution can be loaded into a

needlepunched wipe than a spunlaced wipe for this type of

application,” explained Jeff Girard, Texel’s product manager for

wipes and absorbents. “They save time and money for hospitals, which

is a concern for U.S. hospitals since they are run like companies.

This is not necessarily the case in other parts of the

world.”

According to Mr. Girard, the market in the U.S. for

disposable bathing wipes is $70-80 million in hospitals alone and is

projected to grow to a $300 million market. By 2008, Texel predicts

that the peak of the baby boom generation will reach age 75 and more

elderly parents will require these products in home settings and

nursing homes.

“To get users to switch from a reusable

washcloth to this type of product is a matter of changing habits,”

commented Mr. Girard. “There is also a security factor. With a

traditional washing system, soap has to be diluted in a specific

amount. If there are mistakes, patients’ skin can be burned.” He

predicted that Europe will be an easier market for Bathfelt to

penetrate because of the high price of water. “People don’t have the

same bathing habits in Europe as they do in North America because

they consider the cost of water before they bathe. The wipe culture

in Europe is more developed than the U.S., but there is little

differentiation. Most wiping products are the same with a different

package and name. We see potential here, but you need to manufacture

there otherwise the transportation costs are prohibitive,” he

said.

Now sold as an institutional catalog product, Bathfelt

has not yet made an impact on the retail market but is expected to

do so once the homecare market opens. “This product will take off.

It will be sold on the mass market in private label and branded

versions,” Mr. Girard stated. He added that there are no big players

offering a similar product yet, but he expects this to change. “When

it does,” he said, ”the level of competition and the playing field

will change completely.”

Currently the dominant player in

the disposable bathing wipe market is Sage Products, a producer that

is integrated as both a roll goods producer and converter. The

company reportedly holds approximately 70% of the $70 million

market. “Our strategy has been to create alliances with converters

and associate Texel and other names with the product,” explained Mr.

Girard. “We are underway with an aggressive marketing push. At the

end of the day, marketing will win the war.”

Mr. Girard

stressed that Bathfelt is more economical than a washcloth, lowering

the cost of laundry services and saving caregivers’ time as patients

can be washed more quickly. “However, the union may look at this as

a disadvantage,” he pointed out. “We are not facing it now in the

U.S, but we are facing this type of mentality in Canada. A product

may make sense but external factors may play a role in its ultimate

success. Some people will never switch to it because of such issues.

Economy and safety may be positives, but they aren’t the only

factors, no matter how much sense a product makes,” he said.

Making The Switch

Not

surprisingly, most manufacturers described the trend toward

disposable nonwoven medical fabrics—and away from reusable

products—as one that has already happened in North America, although

companies are enjoying continuing growth in Europe and other parts

of the world. “All the discussions we have had with customers would

indicate that the trend away from reusable and toward disposable

fabrics is growing,” commented Mr. Disley of SAAF, “and more so

outside of North America as presently penetration of nonwovens is

lower but growing.”

According to Miray Pereira, global

business manager for DuPont Medical Packaging, FDA guidelines are

helping this trend along. “The single-use trend in medical devices

is growing and recent FDA regulations on reprocessors of single-use

devices is expected to increase the trend.”

“Europe is

continuing to transition from reusables to single-use products,”

said Ahlstrom FiberComposites’ Mr. Marold. “We are finding this to

be mostly due to the balance of performance and cost of single-use

nonwoven products versus linens. As we continue to promote the

benefits of an engineered nonwoven fabric, the European clinicians

are recognizing the need for improved material performance without a

loss of comfort. Of course, the challenge for nonwovens producers is

to be able to achieve both of these requirements economically,” he

said.

PGI’s Mr. Norman cited more nonwovens displacing

traditional fabrics on the garment side. “In the woven gauze area,

for example, the growth rate has slowed because they were replaced

by nonwovens many years ago. We manage our medical business globally

and this is true worldwide. There is definitely more converting

demand going to Asia and there continues to be roll goods demand in

developed regions,” he offered. Mr. Norman added that PGI is seeing

higher penetration levels in Korea and Japan as well as growth in

disposable nonwovens in Europe. “The U.S. market has been highly

penetrated for a while now,” he suggested.

According to

Georgia-Pacific, continued displacement of traditional fabrics is

happening along with product differentiation. “In the U.S. the

nonwoven washcloth market is pretty well penetrated; however, there

are still hospitals that are using traditional washcloths and soap,”

stated G-P’s Mr. Farren. “We are seeing continued growth even in

penetrated areas because producers are differentiating products by

adding new features and working to lower costs. In the U.S., we are

seeing both growth from displacing traditional materials as well as

growth from product differentiation. Wipers are also a

well-penetrated area, but there are still institutions and hospitals

that are behind the times. This means that there are good

opportunities for continued market growth as more government

regulations are passed and consumers’ expectations grow,” he said.

“There is a continued trend away from reusable products and

this is a viable market segment for nonwovens,” Mr. Farren

continued. ”The healthcare industry is looking for disposable

products because they are more hygienic. By controlling bacteria,

they can reduce costs ultimately. Individual application means less

risk of cross contamination, which is a concern in this

industry.

“In North America, we have already seen a shift to

nonwovens from traditional textiles,” concurred BBA’s Ms. McVey,

“but we are seeing a change in thought from reusables to nonwovens

in Europe. In some areas this shift is slow, but it is

happening.”

From the perspective of Triad’s Mr. Pontililo,

nonwovens have not yet scratched the surface in terms of their

displacement of other fabrics. “There are still many areas where

nonwovens can replace other materials. This is true in patient care,

but it is also true in the medical cleaning market. For instance, a

treated nonwoven can replace spray bottles in industrial and

institutional cleaning applications,” he said. Another potential

area for growth is nonwoven cleanwipes, which could be used to

sterilize. “There is definitely an opportunity for nonwovens in

cleaning applications such as products treated with disinfectant

surface cleaners,” he said.

Unlike some industries—such as

baby diapers or filtration—where the consumer drives technological

innovation, here the onus is on converters and manufacturers to

offer a better, cheaper product. “Facilities generally rely on

companies to supply them with cleaning systems, which traditionally

have centered on alcohol and bleach,” offered Mr. Pontililo. These

facilities look to the industry for cost-savings and efficacy. “They

look to us to be innovators. We get cleaning down to a science by

doing a good job and cutting costs. If you can substantiate that

claim, you will be the vendor.”

Sizing Up The Market

When

it comes to sales—despite concerns over price pressure and

competition—the medical market continues to experience slow but

steady growth at about 2.6-3% per year in North America, according

to INDA, Association of the Nonwoven Fabrics Industry, Cary,

NC. INDA forecasts North American sales to end users

(hospitals, clinics, etc.) at $1.4 billion in 2004. This figure

includes disposable surgical apparel, drapes, caps, masks, shoe

covers, other related apparel, bandages, sponges

and wipes. These disposable medical markets will consume

approximately 1.9 billion square meters of nonwoven materials with a

value close to $320 million, INDA reports. These North

American consumption figures include imports of converted products

but do not include medical exports of disposable

products.

That said, the medical market is predominantly

mature with high penetration levels. Surgical drapes made of

nonwovens have about a 90-95% marketshare in the U.S. medical

market and somewhat lower in Canada, according to

INDA. Nonwoven surgical gowns represent about 80-85% of

the total and are engaged in a tough battle from the reusable gown

industry.

“While the number of surgical

procedures is rising about 5-7% per year, the growth is not

reflected in the volume of disposable surgical gowns and drapes,

which have been rising 2-3% per year,” commented Ian Butler,

director of market research and statistics at INDA. “The reason for

the disparity is that many surgical procedures are not as invasive

and a growing number of procedures are performed outside the

traditional hospital surgical room,” he said.

Like many

issues in the nonwovens industry, just which medical product

segments are experiencing growth is a matter of perspective.

According to Ahlstrom FiberComposites’ Mr. Marold, the company has

experienced growth in most of its segments, although drape and gown

applications are growing much more quickly than sterilization wrap.

“There was a huge surge in facemask demand during the SARS crisis

but that has since subsided and sales of these products are more in

line with conventional growth rates. We are finding growth of drape

and gown applications in Europe to be much greater than those in

North America where these applications are already predominantly

nonwoven.”

From PCC’s perspective, the bed pad sector is

plagued with competition from lower-priced products out of China.

“Lower end finished goods are being sold in the U.S. as one-time use

bed pads,” said the company’s Mr. Dusaj. “The quality and cost of

manufacturing these products is lower. We compete against this by

targeting customers who are specifically interested in reusable

products because of their environmental and long-term cost

advantages. There is a mentality out there that reusable is better,

but we do still need to reiterate this to new customers and in our

advertising so that people understand the advantages of reusable—as

opposed to use-and-throw-away—products. The U.S. lags Europe when it

comes to environmental awareness.” Mr. Dusaj added that tough

competition in the marketplace is exacerbated by the fact that

companies are being forced to pay higher raw material costs that are

not easy to pass on to customers.

Also reporting negative

trends in the bed and soaker pad area is Texel, which is phasing out

its efforts in this segment as part of a strategy to concentrate on

value-added, niche areas. “We have to do this as a small company,”

explained Mr. Girard. He described the market as mature with price

wars that have moved the business to China. According to Texel, roll

goods as well as finished products are being manufactured in China.

Mr. Girard referred to soaker pads as a multimillion-dollar business

that now has products selling for 50% of the price from two years

ago.

“We saw this coming,” he added. “There are no longer

requests for quality. Specifications aren’t tight anymore. It’s now

purely a commodity market where contracts are won on the Internet.

The lowest price wins. Period. We used to say that the products from

China were coming. Well, now they have arrived and they are just

copies of what we have here. It’s not rocket science. They can sell

the finished product for half the price of the needlepunch in it. We

are fighting like crazy just to stay in this market one more year,”

he said.

Texel has not yet seen significant competition from

China in the area of wound care, according to Mr. Girard. “Here roll

goods need to be very clean. The buzz now is that you can add

coatings with antibacterial agents and other additives. It used to

just be one felt that was used. Now there is segmentation; we see

different coatings being used and different felts for wound care,”

he said.

Future Challenges

In

addition to growth, industry experts foresee several sizable

obstacles ahead for the medical market. One such challenge,

according to G-P’s Mr. Farren, is dispersability in washcloths and

other products. “Healthcare workers like disposable products because

they are hygienic, but they need to be disposed of. Here’s where

dispersability is an obstacle. At G-P, we are working on it and have

a patent on this type of dispersable product,” he said.

Mr.

Farren described dispersability as an issue of technology, but one

that won’t require a new nonwovens technology. “There are a lot of

ways to come at dispersability and there are certain price and cost

factors associated with it. The question is whether people will pay

more for this kind of convenience and improved hygiene.” He added

that G-P is working out cost issues and has found ways

dispersability can be created. Looking forward, Mr. Farren believes

the companies that can achieve dispersability will have a major

opportunity for growth.

According to Mr. Farren, currently

there are smaller sized wipers being used in hospitals and nursing

homes that are making it through the pipes after being flushed. Such

wipers are flushable, but are not necessarily dispersible and are

not the easiest size for healthcare providers to work with. The key,

he said, is to create dispersability in large-sized wipers. “Size

and dispersability will be the winning combination. The market

demands ease of use and disposal. Disposing of the product should

not be a problem.”

Mr. Marold of Ahlstrom pointed to comfort

as a future challenge for nonwovens in medical applications. “The

medical consumer is becoming more aware of the risks they are

exposed to in their daily activities,” he explained. “At the same

time, there is a high desire to be comfortable when performing their

activities in order to maintain their stamina and concentration on

the task at hand—healing. As such, Ahlstrom has invested in the

ability to produce a variety of nonwovens and then engineer products

that promote protection yet are comfortable for extended surgeries.

These products have been successfully introduced in North America,

and we are starting to see some very keen interest in Europe and

Asia,” stated Mr. Marold.

For Triad, foreign competition

represents a significant obstacle for medical nonwovens. “Foreign

markets are affecting our business. We try to keep a strong eye on

foreign competition because it is a prime concern as we develop new

products,” said Mr. Pontililo. “Competition is coming from the

Pacific-Rim, specifically there are a lot of Korean products out

there. There was a time when roll goods were coming out of this

area, now we are seeing converted goods as well,” he said. “In the

medical market, quality is still an issue, so domestic converters

have an advantage there. But in the household area, the quality

issue does not have as significant an impact.”

Streamlining

the value chain is the key challenge that lies ahead, according to

BBA’s Ms. McVey. “ In the medical nonwovens arena, North America is

the strongest market and there are a lot of producers here. Most

competition comes from other North American roll goods producers.

What we are seeing is more products being shipped overseas and

treated, converted or packaged and then shipped back. The key

question today is ‘how can we streamline this value chain?’ The

needs of U.S. customers are different than those of European or even

Asian customers. Moving forward, the challenge we face is whether we

can manage this globally or will it remain regional? Five years from

now, I predict that we will be looking at a very different

landscape,” she said.

“The push to keep costs down will

continue and to respond to this pressure, producers will need to

form stronger partnerships and allegiances to get this done,” Ms.

McVey continued. “It’s not an every man for himself philosophy

anymore. How can we team up to open new markets and keep costs down?

We see resin and roll goods producers partnering, now we need to get

the medical end product manufacturer involved to generate the best

solutions. This does not happen enough. We still have a

supplier/customer mentality, but we’ll see more partnerships moving

ahead.”

For the future, hospital-acquired infection is

expected to be another area of substantial concern for employees,

patients and visitors. Greater awareness of protection for both

patients and healthcare providers and the recognition of the cost of

cross-infection within healthcare establishments is driving the

industry to develop higher quality fabrics to address these issues.

“The argument about the direct cost of laundering versus disposables

becomes minor against the cost of cross-infection,” opined SAAF’s

Mr. Disley.

“While we are not certain that the SARS effect

has passed, it certainly has not reached the concern levels of

2002,” said Ahlstrom’s Mr. Marold. “However, today there is an even

stronger awareness of the risks of ‘superbugs’ and the need to

protect caregivers from these. Most recently, the avian flu is

afflicting Europe, North America and Asia, creating a concern over

clinician protection. Hopefully, through the use of single-use

nonwoven fabrics, these types of viruses won’t spread at the same

level as SARS did.”

Participating in the ribbon cutting ceremony were (l-r) Wang Yang-Xi, CNTA; Krzysztof Malowaniec, EDANA; Leo Cancio, INDA; Tai Jung Chi, ANFA; Sheng Tao, CNITA and Laerte Guiao Maroni, ABINT.

More than 6000 members of the nonwovens industry attended IDEA 01,

held March 27-29 at the Miami Beach Convention Center, Miami, FL. With

visitors from 60 countries and more than one-third of the approximately

400 exhibitors coming from outside the U.S., IDEA 01 definitely lived up

to its reputation as a global show. Many exhibitors commented on the large

presence of attendees from Asian and South American countries as well.

The show kicked off on Monday, March 26 with a welcome reception

at the Fontainbleu Hotel in Miami sponsored by IDEA organizer INDA,

Association of the Nonwoven Fabrics Industry, Cary, NC. On Tuesday March

27, IDEA 01 officially opened with a ribbon cutting, as well as the

keynote speech “Nonwoven Based Businesses At 3M” delivered by Dr. Paul

Guehler, senior vice president of R&D at 3M, St. Paul, MN. Dr.

Guehler’s presentation gave a breakdown of the nonwovens capabilities of

3M mentioning that the company plans to pursue small to medium markets in

the future by using higher valued products and looking for rewarding

niches and turning them into canyons. As part of his speech, Dr. Guehler

said that the nonwovens industry is slated for robust growth from 2001 to

2006 with industry experts projecting a 7.3% annual growth

rate.

Additionally, Tuesday also saw the presentation of the

inaugural IDEA 01 Achievement Awards co-sponsored by INDA and Nonwovens

Industry.

In conjunction with the exhibition, the IDEA 01

Conference was held during the morning hours of March 27-29 and featured

more than 40 speakers from eight end use areas for nonwovens, including

products for the home, wipes, filtration, hygiene, medical, automotive,

geotextiles and protective apparel. Additionally, those new to the

nonwovens industry were invited to take part in a two hour “Fundamentals

Of Nonwovens” course taught by Edward Vaughn of Clemson University,

Clemson, SC. For conference attendees interested in learning more about

e-business, IDEA 01 also featured “Enterprise Solutions,” a special

conference session led by Jim Lester of Compaq Computers, Houston, TX,

that discussed getting started in e-business, e-commerce and

e-security.

Roll Goods Manufacturers Bring It

On

The IDEA 01 exhibition drew a large crowd of roll goods

suppliers from all corners of the globe who used this opportunity to

highlight some of their latest product offerings.

AET

Specialty Nets & Nonwovens, Middletown, DE, highlighted its

new melt blown composites, its “DelNet” support netting membrane and two

new medical laminates. Additionally, the company had information on its

new “Plastinet FinGuard” thermoplastic netting for air conditioner

condenser fin protection, which features ease of handling and specified

hole size and strand count.

In its first major trade show

appearance since its merger with Dexter Corporation Nonwovens Materials,

Windsor Locks, CT, last year, Ahlstrom Paper Group, Arnhem, The

Netherlands, showcased its wipes business. The union of Ahlstrom

and Dexter created a significant new resource for convertors and marketers

of wipes materials, according to company executives. The company can

combine a variety of fibers—wood pulp, cotton, rayon, polyester and

polypropylene—with proprietary processes and in line treatments to meet

any requirement. Applications include disposable, embossable, textured

abrasive and exfoliating wipes.

American Nonwovens, Columbus,

MS, featured its resin bonded and needlepunched products made from

“Tencel,” for which the company is currently trying areas where the

special properties of these products could be used. Additionally, American

Nonwovens discussed its fabrics made from “Eastar Bio” copolyester by

Eastman Chemical, Kingsport, TN, which received the IDEA 01

Fibers/Chemical Achievement Award during the show.

Avgol

Limited Nonwoven Industries, Holon, Israel, announced at the show

that it plans to build a plant in the U.S. A detailed announcement on this

move was expected to come by the end of April.

One of the most

significant new product introductions at IDEA 01 was initiated by BBA Nonwovens, London, U.K. The company unveiled a line of

spunbond and SMS nonwovens and announced the launch of a proprietary

spunmelt forming technology and class of spunmelts. BBA also introduced

“Flite 4.0,” a fourth generation spunmelt nonwoven that offers a broader

range of fiber deniers, while the company’s Industrial Nonwovens business

has expanded its “Ultraflo” range of filtration media (see Nonwovens News,

p. 14).

Under the theme “complete solutions,” the booth of the BP Fabrics & Fibers Business Unit, Austell, GA,

presented show attendees with the company’s full range of nonwovens, films

and composites that can be designed to solve specific customer problems.

While these problem solutions are mainly targeted towards the hygiene and

medical arenas, due to the use of breathable materials BP is able to

penetrate industrial markets.

Consumer Products Enterprises

(CPE), Union, SC, introduced show attendees to the newest members

of its senior management—new president and CEO Charles Smith and new sales

manager nonwovens Richard Carr. On the technology front, CPE spotlighted

the manufacturing capabilities of its new state-of-the-art needlepunching

line that has the ability to run synthetic fibers and bring in colored

needlepunched nonwovens. The company is reportedly seeing a lot of

customer interest in colored materials for the wipes, home furnishings,

geotextile and agricultural areas.

Crane Nonwovens, Dalton,

MA, introduced a new family of wipe materials suitable for use in

a wide range of demanding commercial and consumer applications. These

hydroentangled fabrics are available in soft, absorbent cotton, high

strength blends and economical wood pulp. Additionally, the company

showcased “Cranemat FD,” a media for liquid and air filtration

applications featuring a fine denier polyester blend.

The booth

for Dounor SA, Neuville en Ferrain, France, was dedicated to

the promotion of the company’s new monofilament spunbond fabrics made from

a special polymer called “Metallocene” that allows for the production of a

thinner filament, resulting in a softer fabric. With the new polymer,

material weights can go down to 12 gpsm that were once only capable of 15

gpsm with the same or better strength and improved web uniformity. While

Dounor is currently targeting the hygiene market due to the product’s

softness, it sees opportunities in other applications as

well.

DuPont, Wilmington, DE, exhibited its “Hytrel”

polyester elastomer, which is being used in single-use surgical gowns

manufactured by Allegiance Healthcare Corporation, McGaw Park, IL. Gowns

made with Hytrel are breathable because the elastomer allows the diffusion

and evaporation of sweat moisture. Furthermore, the monolithic film of

Hydrel provides an impervious barrier to fluid penetration, allowing the

gowns to resist penetration by blood-borne pathogens. Hytrel has other

applications in hygiene products, outerwear and

geotextiles.

Newly-named First Quality Nonwovens, Hazleton,

PA—which was most recently known as First Quality Fibers—was on

hand at IDEA 01 to promote its capacity expansion with the addition of two

new lines at its Hazleton facility, scheduled to come onstream later this

year. The move will allow the company to expand its ability to make

spunbond and SMS materials.

The world’s largest roll goods producer The Freudenberg Nonwovens Group, Weinheim, Germany,

showcased its new “Evolon” fabric, which was one of the three finalists

for the IDEA 01 Roll Goods Achievement Award. Manufactured through a

proprietary process that combines filament spinning and web formation,

Evolon offers good drapability, soft hand, high tensile strength, comfort

properties and good launderability for a variety of

applications.

Making its IDEA debut after its acquisition of roll

goods producer Fort James was Georgia-Pacific (G-P) Nonwovens Group,

Green Bay, WI. The latest products showcased included air laid

fabrics with SAP fibers and powders, new binders and new fiber blends and

additives such as antimicrobial additives, which the company is currently

producing and customizing for air laid and carded nonwovens. As for G-P’s

Italian business, it is continuing to target the feminine hygiene market

and is beginning to target the tabletop wet wipes area, while the French

segment is continuing to increase business in the feminine hygiene and

food packaging areas and develop new products, including a

solvent-resistant air laid product for industrial wiping applications.

Green Bay Nonwovens, Green Bay, WI displayed samples

of its spunlaced products made with a variety of different fibers and

available in a variety of weight grades. These fabrics offer high strength

and drapability as well as soft hand. Green Bay also offers materials

produced through a resin-bonded process where natural and/or synthetic

fibers are blended together and formed web through a series of

cards.

Nonwovens-newcomer GSE Nonwoven Technology Company,

Kingstree, SC, made its debut at IDEA 01 to announce it has

commercialized ist new line ahead of schedule. Additionally, GSE has

already made its first shipment of product. GSE produces needlepunch

materials for a range of markets under its “GSE Symmetrec” brand name

(see Nonwovens Industry April 2001, pg. 84 in the print

version).

Hollingsworth & Vose, East Walpole,

MA, showcased its new “Technostat” filtration product. The

electret nonwoven filtration media uses electrostatically-charged fibers

to offer high efficiency and low resistance. Additionally, H&V

showcased some of its “AFN” high-tech glass and carbon products, as well

as samples of materials from its newly-acquired roll goods producer J.C.

Binzer Papierfabrik, Hatzfeld, Germany (see Nonwovens Industry April 2001,

pg. 10).

ITP Sellars, Milwaukee, WI, displayed its

line of chemical bonded nonwoven fabrics. The line of 10 different styles

have a basis weight ranging from 34 to 85 gpsm with a number of different

fibers, including 100% rayon, 100% polyester or an equal combination of

the two.

Johns Manville, Denver, CO, distributed

information on its European capacity expansions expected to come onstream

during the next six months. These expannsions include a new polyester

spunbond line and two new glass media lines (see Nonwovens Industry

January 2001, p. 10).

Mogul Spunbond-Meltblown Nonwovens,

Gaziantep, Turkey, was exhibiting its 100% polypropylene spunbond

nonwovens with colored, hydrophilic, antistatic, flame retardant, antidust

mite and antibacterial treatments.

The focus of Monadnock

Nonwovens’ display was on melt blown nonwovens for liquid and air

filtration media as well as disposable vacuum bags. The Stroudsburg,

PA-based company produces a variety of different grades of melt blown

materials.

Mytrex Industries, Taoyuan, Taiwan,

promoted its “Electret” melt blown face mask media at the IDEA show. The

material provides high efficiency, low pressure and good barrier

properties coupled with open fiber structures, giving a tortuous path

along with electrostatic attraction without compromising air

flow.

National Nonwovens, Easthampton, MA, showcased

its “Atvantage” and “ProTechtor” lines of products. The Atvantage

composite insulating and structural cores produce moldable, needled

nonwovens for thermal insulation, vibration dampening and acoustic

attenuation. The moldable, lightweight ProTechtor composite ballistic

shield utilizes advanced needling technology. It maintains properties when

cut into small sections, making it an ideal solution for armor, blast

containment, protective apparel and fire protection applications.

Despite its large booth presence at the show, Polymer Group

Inc. (PGI), Dayton, NJ, had a special room set aside at the

Fontainbleu Hotel to talk to customers about the latest innovations with

its “Miratec” technology in a more private setting. New products included

the substrate for “Swiffer” made by Procter & Gamble, Cincinnati, OH

and winner of the IDEA 01 Short-Life End Product Achievement Award.

Miratec is also presently being used in outdoor seating cushions and

within the bedding market for comforters, quilts and mattress pads. On the

apparel side, PGI is focusing on casual pants for men and women, which are

currently being marketed in Japan under a well-known brand. PGI is also

utilizing Miratec in the automotive market for headliner, seat and door

panel applications.

Vliesstoffwerk Chr. H. Sandler GmbH,

Schwarzenbach, Germany, spotlighted a number of product

innovations at the IDEA 01 show. Among these products were wet and dry

wipes for various applications, such as technical, hygiene and cosmetic.

These new products have reportedly come about from the growth explosion of

wipes for different areas in Europe. The company also showcased its

laminates for apertured topsheet applications, its grooved

acquisition/distribution layer, partial lamination strip laminates,

structural elements for automobiles and its new “Sawagrow” agricultural

product.

Shalag Industries, Upper Galilee, Israel,

introduced its “ShalagTwins” concept that produces two complementary

layers in one absorbent pad. The first layer is a multihydrophilic

topsheet of perfect uniformity and excellent mechanical strength. The

second layer is a cost-efficient acquisition distribution layer.

Roll goods producer SI Corporation, Chattanooga, TN,

displayed its “Xtinguish” line of products. The company is currently

expanding this line of self-extinguishing fabric for bedding and furniture

applications in the home furnishings market and automotive applications

due to government regulations.

J. W. Suominen Oy, Nakkila,

Finland, exhibited its nonwoven roll goods for the hygiene,

medical and wipes markets. Of particular interest was the company’s

“Fibrella,” a hydroentangled nonwoven that offers advanced qualities for

use in health care and medical applications.

Tex Tech

Industries, Portland, ME, highlighted its new product lines of

tubular needlepunched nonwovens for several end use applications,

including insulation and aluminum extrusion. The company also told IDEA

attendees about the broad range of fibers it can process for high

temperature applications.

Kowloon, Hong Kong-based U.S.

Pacific Nonwovens Industry Ltd. showcased a variety of new

products at the show. One such product was a spunbond nonwoven pop-up tent

for outdoor activities that can be laminated to become waterproof.

Secondly was a reflective survival blank made of a spunbond laminated to a

metallic film or spunlace material. The blanket offers great heat

retention as the metallic film reflects body heat back to the body. U.S.

Pacific is currently working on deals with major automotive manufacturers

to promote having the product in cars so people can use it for warmth

during an emergency.

Western Nonwovens (WNI), Carson,

CA, highlighted a variety of new products and technologies at the

IDEA show. Among them was “Nu-Foam” densified foam replacement product for

the arts and crafts and mattress markets, which is a response to interest

in replacing foam because of problems with it burning and discoloring. The

company also introduced its new bedding products using “Outlast” thermal

polyester fiber that help to regulate temperature, as well as “PolarGuard

Delta,” the latest addition to its product family that takes about 10-12%

of the weight out of original product and still achieves the same

warmth/weight value.

Raw Material Producers Supply

Innovation

Suppliers of raw material products to the

nonwovens industry, such as fibers and binders, were on hand to discuss

their latest and greatest with attendees of IDEA 01.

Aegis

Environments, Midland, MI, announced the full integration of its

proprietary antimicrobial program “Aegis Microbe Shield.” The program uses

a non-leaching technology that controls microbes by physically piercing

and disrupting the ionic components of the cell membrane. It can be

readily incorporated into any wet finish process and applied to any

textile product to inhibit microbial odors, staining and

deterioration.

Air Products, Allentown, PA,

introduced a broad array of developmental products that are designed to

bring unique performance advantages to nonwovens, such as the “Airflex 181

DEV” self-laminating binder and the “Airflex 114 DEV” nonionic binder that

is compatible with cationic additives. “Airflex 1555 DEV” is a transport

layer finder that offers excellent resiliency, acquisition and rewet and

allows cellulose structures to replace synthetics. Additionally, Air

Products highlighted three experimental-stage products with unique

characteristics such as low-temperature cure, increased adhesion to

synthetics and high-temperature performance—“Airflex LTC,” “Airflex IAS”

and “Airflex HTP.”

Atlantic Extrusions Corporation, Salem,

MA, featured its “StrongNet” reinforcement laminates. StrongNet is

oriented in two positions to provide an exceptional high

strength-to-weight ratio with each biplanar joint becoming an integral

part of the netting. Produced using polyolefin polymers, StrongNet will

not corrode, rot or rust and is virtually unaffected by water, most acids,

gases, chemicals and organic materials.

Barnhardt

Manufacturing, Charlotte, NC, used the show to launch four new

products—“UltraBlock,” “UltraScent,” “UltraSorb” and “Needle-Eze.”

UltraBlock features the benefits of bleached cotton combined with a

durable antimicrobial finish and UltraScent is available in a choice of

fragrances that do not wash off. UltraSorb is a cotton product with an